| ■ | determining the compensation of our presidentDetermining the compensation of our President and CEO and other executive officers; Reviewing and approving general salary and compensation policies for the rest of our senior officers; | ■ | reviewing and approving general salary and compensation policies for the rest of our senior officers; |

| ■ | overseeing the administration of our Annual Incentive Compensation Plan (AICP), equity incentive plans, and Employee Stock Purchase Plan; |

Overseeing the administration of our Annual Incentive Compensation Plan (AICP), equity incentive plans, and Employee Stock Purchase Plan; | ■ | assisting management in designing new compensation policies and plans; and |

Assisting management in designing new compensation policies and plans; | ■ | reviewingReviewing and providing guidance to management concerning succession plans and development actions for key leadership roles; Reviewing and assisting management regarding diversity and inclusion efforts across the Company; and Reviewing and discussing the Compensation Discussion and Analysis contained in this proxy statement and other compensation disclosures with management. |

Delegation Authority

The Compensation Committee has delegated compensation decisions regarding nonexecutive officers, including the establishment of specific salary and incentive compensation levels and certain matters relating to stock-based compensation, to the Management Compensation Committee, a committee comprised of senior leaders of Price Group.

Committee Procedures

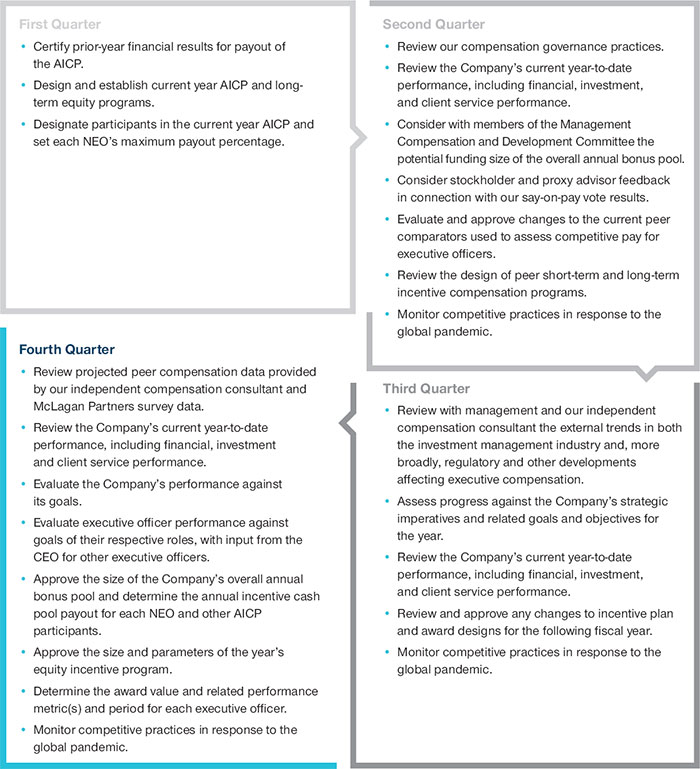

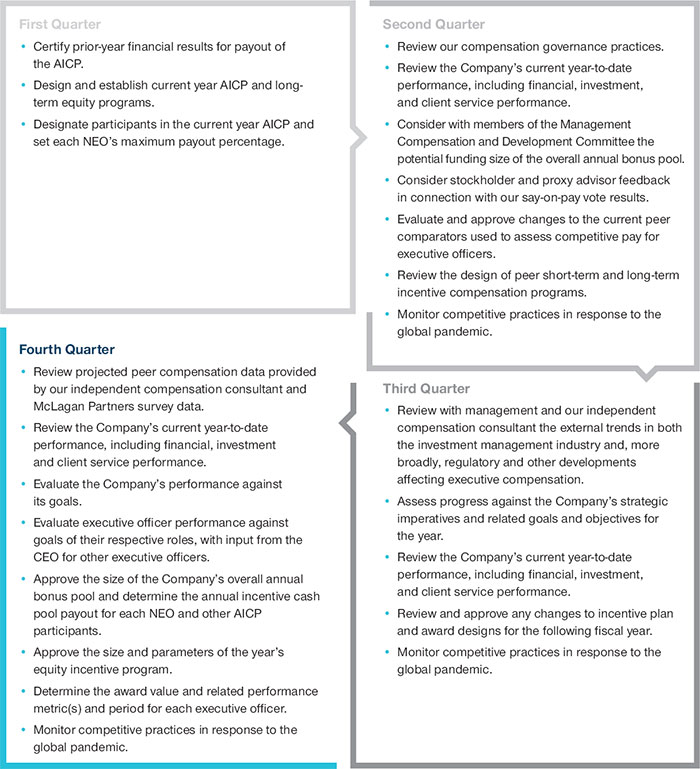

Early each year, the Compensation Committee meets with the president and CEO and members of senior management in order to discuss goals and objectives for the coming year, including goals and objectives applicable to the named executive officers (NEOs) listed in our Summary Compensation Table. In addition, the Compensation Committee determines eligibility for the AICP bonus pool and sets forth the maximum percentage that may be paid to each participant. At its meeting in December, the Compensation Committee evaluates executive performance during the year as part of its determination of appropriate incentive compensation awards.

The Compensation Committee awards annual equity incentive grants to employees from stockholder-approved long-term incentive plans as part of the Company’s annual compensation program.

Role of Executive Officers

The Compensation Committee solicits input from the president and CEO and the Management Compensation Committee regarding general compensation policies, including the appropriate level and mix of compensation. The Compensation Committee also consults with the president and CEO regarding the appropriate bonus and salary levels for other executive officers.

Role of Compensation Consultants

Johnson Associates has been the Compensation Committee’s compensation consultant, since 2017. Johnson Associates has no relationship with Price Group other than as the Compensation Committee’s consultant. See the “Role of Independent Compensation Consultant” section of our Compensation Discussion and Analysis for additional details of their role.contained in this proxy statement and other compensation disclosures with management.

| Nominating and Corporate Governance Committee | | Meetings in 2020: 5 | | Chair | | Members | | | | | | The report of the Committee

appears on page 20. | |  | |  | |  |  | |  | | | Snowe | | Bush | | Hrabowski | Stevens | | Wilson |

Nominating and Corporate Governance Committee

Mses. Snowe and Bush, and Mr. Wilson serve on our Nominating and Corporate Governance Committee, which met on six occasions during 2018. The Board of Directors has determined that all Nominating and Corporate Governance Committee members meet the independence criteria of the NASDAQ Global Select Market.

Responsibilities The principal purposeNominating and goal of this committee is to maintainCorporate Governance Committee supervises and cultivatereviews the effectivenessaffairs of Price Group’sGroup in relation to the Board, of Directorsdirector nominees and oversee itscompensation, committee composition, stockholder communications, and other corporate governance policies. matters. Among the Nominating and Corporate Governance Committee’s responsibilities are Boardare: Identifying, evaluating, and committee composition,nominating director qualifications,candidates. Considering the continued membership of each director, and recommending the appropriate skills and characteristics of potential directors. Developing director orientation and education opportunities. Reviewing and Board evaluations. Members identify, evaluate, and nominate Board candidates; reviewapproving the compensation of independent directors;directors. Recommending committee and overseechair assignments. Overseeing procedures regarding stockholder nominations and other communications to the Board. In addition, they are responsible for monitoring Reviewing the effectiveness of the Board in the corporate governance process. Monitoring compliance with and recommending any changes to the Company’s Corporate Governance Guidelines.Guidelines and other governance policies. Monitoring and oversight of, in coordination with the Compensation Committee and the Board, succession planning for the Chief Executive Officer. Overseeing policies related to political expenditures and political activities. Monitoring policies related to environmental and climate matters, and recommending to the Board specific actions related thereto. Reviewing actions in furtherance of the Company’s corporate social responsibility, including the impact of the Company’s processes on employees, stockholders, citizens and communities. Reviewing key trends in legislation, regulation, litigation and public debate to determine whether the Company should consider additional corporate environmental, social responsibility or governance actions. | Executive Committee | | Chair | | Members | | |  | |  | |  | | Stromberg | | Wilson | | MacLellan |

During 2020, Mr. Stromberg, Mr. MacLellan and Mr. Wilson served on the Executive Committee. Responsibilities The Executive Committee functions between meetings of the Board in the event that prompt action be called for that requires formal action by or on behalf of the Board in circumstances where it is impractical to call and hold a full meeting of the Board. The Executive Committee possesses the authority to exercise all the powers of the Board except as limited by Maryland law. If the Executive Committee acts on matters requiring formal Board action, those acts are reported to the Board at its next meeting for ratification. Governance Policies and Procedures Code of Ethics Pursuant to rules promulgated under the Sarbanes-Oxley Act, the Board has adopted a Code of Ethics for Principal Executive and Senior Financial Officers. This Code is intended to deter wrongdoing and promote honest and ethical conduct; full, timely, and accurate reporting; compliance with laws; and accountability for adherence to the Code, including internal reporting of Code violations. A reportcopy of the Code of Ethics for Principal Executive and Senior Financial Officers is available on our website. We intend to satisfy the disclosure requirements regarding any amendment to, or waiver from, a provision of the Code of Ethics for Principal Executive and Senior Financial Officers by making disclosures concerning such matters available on the Investor Relations page of our website. We also have a Code of Ethics and Conduct that is applicable to all employees and directors of the Company. Our Code of Ethics and Conduct prohibits all employees and directors of the Company from (i) any short sales of our common stock, (ii) purchasing options on our common stock, or (iii) entering into any contract or purchasing any instrument designed to hedge or offset any decrease in the market value of our common stock. It is the Company’s policy for all employees to participate annually in continuing education and training relating to the Code of Ethics and Conduct. Corporate Governance Guidelines The Board represents the interests of stockholders in fostering a business that is successful in all respects. The Board is responsible for determining that the Company is managed with this objective in mind and that management is executing its responsibilities. The Board’s responsibility is to regularly monitor the effectiveness of management policies and decisions, including the execution of its strategies. In addition to fulfilling its obligations for representing the interests of stockholders, the Board has responsibility to the Company’s employees, the mutual funds and investment portfolios that the Company manages, the Company’s other customers and business constituents and the communities where the Company operates. All are essential to a successful business. Our Corporate Governance Guidelines can be found on our website, troweprice.com. Non-Employee Director Independence Determinations The Board has considered the independence of current Board members and nominees not employed by the Company and has concluded each such director qualifies as an independent director within the meaning of the applicable rules of the NASDAQ Global Select Market. To our knowledge, there are no family relationships among our directors or executive officers. In making its determination of independence, the Board applied guidelines that it has adopted concluding that the following relationships should not be considered material relationships that would impair a director’s independence: relationships where a director or an immediate family member of a director purchases or acquires investment services, investment securities, or similar products and services from the Company or one of its sponsored mutual funds and trusts (Price funds) so long as the relationship is on terms consistent with those generally available to other persons doing business with the Company, its subsidiaries, or its sponsored investment products; and relationships where a corporation, partnership, or other entity with respect to which a director or an immediate family member of a director is an officer, director, employee, partner, or member purchases services from the Company, including investment management or defined contribution retirement plan services, on terms consistent with those generally available to other entities doing business with the Company or its subsidiaries. The Board believes that this policy sets an appropriate standard for dealing with ordinary course of business relationships that may arise from time to time. Election of Directors In this proxy statement, eleven director nominees are presented pursuant to the recommendation of the Nominating and Corporate Governance Committee. All have been nominated by the Board to hold office until the next annual meeting of stockholders and until their respective successors are elected and qualify.  | FOR | Recommendation of the Board of Directors | Vote Required | | We recommend that you vote FOR all the director nominees under Proposal 1. | |

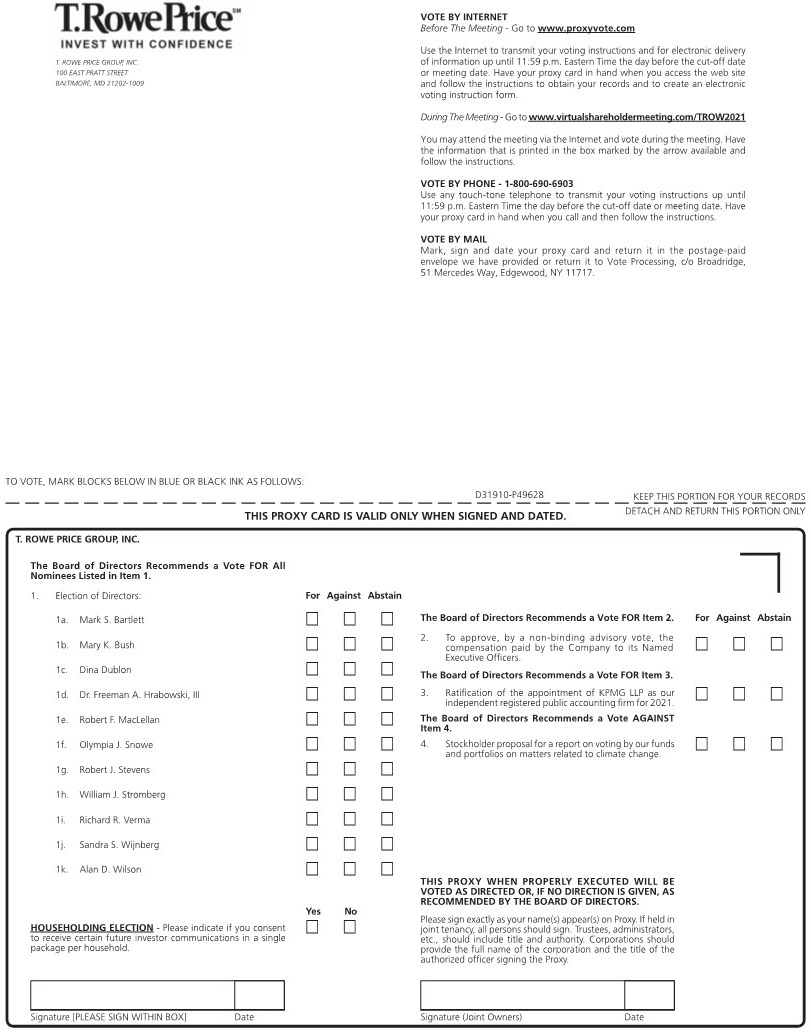

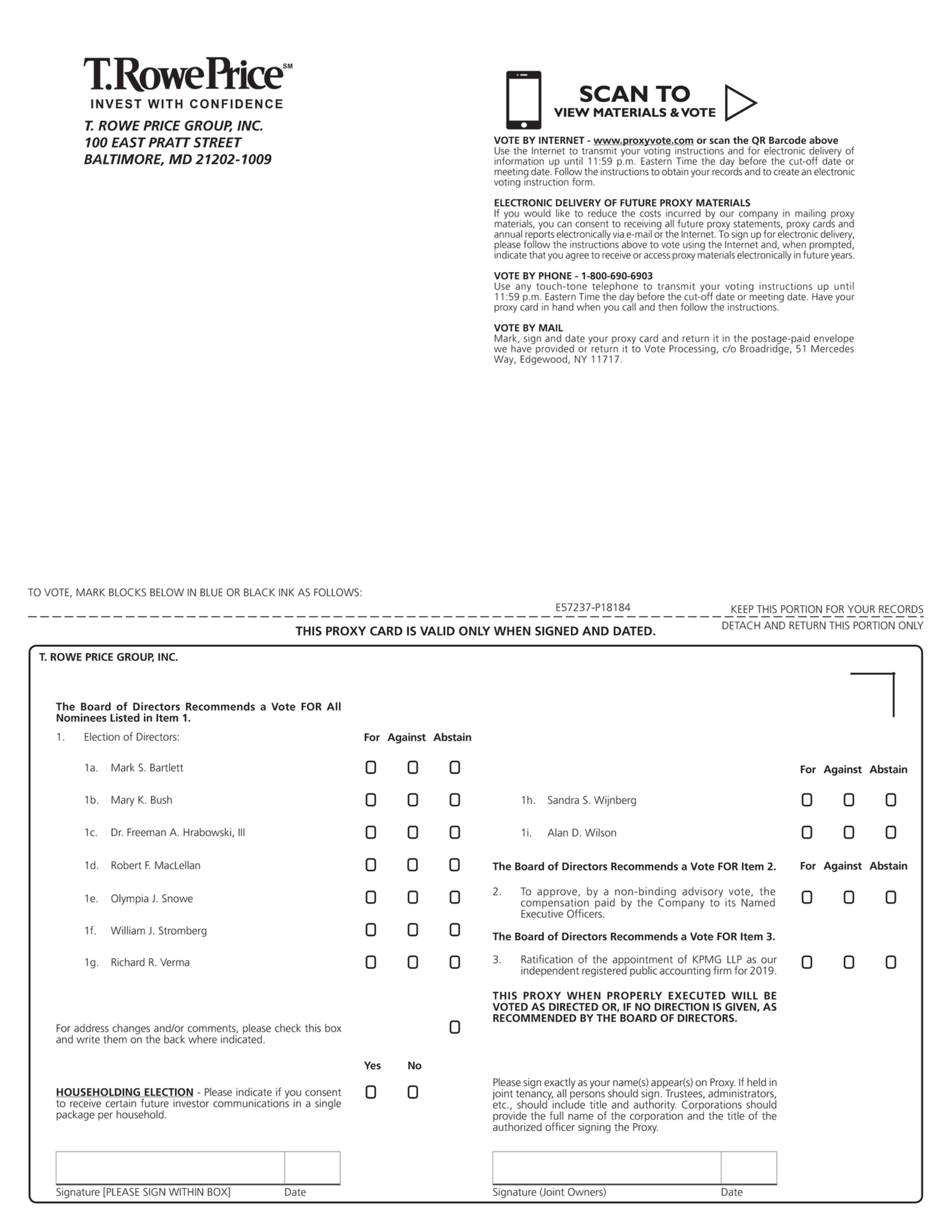

All properly executed proxies received in time to be tabulated for the Annual Meeting will be voted FOR the election of the director nominees unless otherwise specified. Shares held by a bank, broker, or other nominee will not be voted on this Proposal absent specific instruction from you, which means your shares may go unvoted and not affect the outcome if you do not specify a vote. If any director nominee becomes unable or unwilling to serve between now and the Annual Meeting, proxies will be voted FOR the election of a replacement recommended by the Nominating and Corporate Governance Committee and approved by the Board. Corporate Governance Report of the Nominating and Corporate Governance Committee Our Nominating and Corporate Governance Committee has general oversight responsibility for governance of the Company, including the assessment and recruitment of new director candidates and the evaluation of director and Board performance. We monitor regulatory and other developments in the governance area with a view toward both legal compliance and maintaining governance procedures at the Company consistent with what we consider to be best practices. In this regard, we routinely receive written and verbal information relating to best governance practices for institutions such as the Company, including input and reports from members of the Company’s proxy voting group concerning relevant trends. Board Engagement In Crisis Response In response to the COVID-19 pandemic, from March through June, the Board began holding bi-weekly special meetings to ensure the Company was well positioned to protect the health and safety of our associates, meet the evolving demands of our clients, and navigate market changes. The Board empowered management to take actions to protect the Company’s associates through remote work programs, supported investments in technology updates and business continuity solutions, and maintained oversight of our balance sheet to ensure the Company’s financial strength. During these meetings the Board also advised on the firm’s internal and external communication strategy and risk mitigation efforts with a view to the long-term success of the enterprise. The Board engaged with management on identifying and addressing strategic risks and opportunities arising out of COVID-19. During the pandemic, we adjusted our planned in-person Board meetings to hold them virtually to ensure continued effective functioning of the Board. Later in the spring, in response to the social unrest which swept across the U.S., the Board and management committed to develop programs and policies supporting the Board’s view that racial injustice was a serious problem which the Company was committed to combat. Governance Highlights Overview Our Board employs practices that foster effective Board oversight of critical matters such as strategy, management succession planning, financial and other controls, risk management and compliance. The Board reviews our major governance policies and processes regularly in the context of current corporate governance trends, regulatory changes and recognized best practices. During the year, the Board determined to heighten its focus on the Company’s environmental, social and governance matters from a corporate perspective. In furtherance of this goal, the Board received various updates from management on the Company’s environmental, social and governance efforts, and ultimately determined to amend the Nominating and Corporate Governance Committee’s charter to include oversight of the Company’s environmental and corporate social responsibility activities, beginsincluding considering the impact of the Company’s policies and processes on page 17employees, stockholders, citizens and communities. In addition, the Nominating and Corporate Governance Committee’s charter was amended to include oversight of this proxy statement.the Company’s policies related to political expenditures and political activities. Of note, however, is that the Company does not contribute corporate funds to candidates, political party committees, political action committees, or any political organization exempt from federal income taxes. Further the Company does not maintain a political action committee and does not spend corporate funds directly on independent expenditures. The Nominating and Corporate Governance Committee works diligently to support effective corporate governance and believes that the Company’s governance program aligns with the Investor Stewardship Group’s (ISG) Corporate Governance Framework for U.S. Listed Companies. TABLE OF CONTENTSTable of Contents

Management CommitteeISG Corporate Governance Principles

The Management Committee is responsiblefollowing sections provide an overview of our corporate governance structure and processes, including key aspects of our Board operations, and how they align with the ISG Corporate Governance Principles for guiding, implementing,U.S. Listed Companies.

| PRINCIPLE | | COMPANY PRACTICE | | 1. Boards are accountable to shareholders. | | • Our directors are elected annually. • Our By-Laws mandate that directors be elected under a “majority voting” standard in uncontested elections. Each director nominee must receive more votes “For” his or her election than votes “Against” in order to be elected. A director who fails to obtain the required vote in an uncontested election must submit his or her resignation to the Board. • We have clear proxy access rules. • We do not have a poison pill plan. | | 2. Shareholders should be entitled to voting rights in proportion to their economic interest. | | • We have only one class of stock outstanding, and each share is entitled to one vote. | | 3. Boards should be responsive to shareholders and be proactive in order to understand their perspectives. | | • Our Company actively engages with stockholders, see page 25. • Our directors participate in our stockholder outreach, both in the preparation for such meetings, and during the presentations themselves. • We have established an email address for stockholders wishing to contact the Board. | | 4. Boards should have a strong, independent leadership structure. | | • We have a strong lead independent director. • Ten of our eleven board members are independent. • Our independent directors meet frequently without management. | | 5. Boards should adopt structures and practices that enhance their effectiveness. | | • Our directors have a diverse mix of experience and backgrounds relevant to our industry, our stockholders, our clients, and our stakeholders. See page 7. • The average tenure on our Board is six years. • During the year, the Board receives several key industry updates, strategic topics and other education sessions conducted by both outside experts and Company executives, all designed to assist the Board in executing their duties. • Our directors attended 100% of the Board and Committee meetings, and value in person attendance at meetings. | | 6. Boards should develop management incentive structures that are aligned with the long-term strategy of the company. | | • Our annual and long-term incentive programs are designed to align the interests of our management with our stockholders by focusing on long-term corporate performance and value creation. • Our executive compensation program received over 95% stockholder support in 2020. • The proxy statement clearly communicates the link between our compensation programs and the Company’s short and long-term performance. |

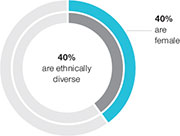

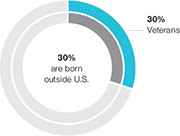

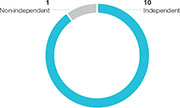

Board Composition Director Nomination Process Ongoing Assessment of Composition and reviewing major policyStructure In considering the overall qualifications of our nominees and operating initiativestheir contributions to our Board, and in determining our need for additional members of the Company. Mr. StrombergBoard, we seek to create a Board consisting of members with a diverse set of experiences and attributes who will be meaningfully involved in our Board activities and will facilitate a transparent and collaborative atmosphere and culture. Our Board members generally develop a long-term association with the Company, which we believe facilitates a deeper knowledge of our business and its strategies, opportunities, risks, and challenges. At the same time, we periodically look for additions to our Board to enhance our capabilities and bring new perspectives and ideas to our Board. Commitment to Diversity and Inclusion The Board has historically valued varying perspectives that individuals of differing backgrounds and experiences bring. We monitor the diversity profile of the Board and consider it an important factor relevant to any particular nominee and to the overall composition of our Board. In considering diversity, we recognize a person’s background and experience as well as their ethnic, gender, sexual orientation, racial, and other factors which we believe will inform the way they consider decisions brought before the Board. Our current Board comprises individuals with a substantial variety of skills and expertise, including with respect to executive management; financial institutions; government; accounting and finance; investment management; public company boards; academia; and not-for-profit organizations. Our Board is not just comprised of individuals knowledgeable about our business, but is also reflective of our clients, the communities we serve and our stakeholders. The Nominating and Corporate Governance Committee believes it is important to maintain a mix of experienced directors with a deep understanding of the Company and newer directors who bring a fresh perspective to the challenges of our industry. Board Replenishment The Board has eleven directors, ten of whom are independent. The tenure of our independent directors’ ranges from eighteen months to eleven years, with an average tenure of approximately six years. In considering Board membership, the Nominating and Corporate Governance Committee focuses on identifying candidates with the skills and backgrounds to complement the Board, in addition to seeking candidates who would bring further capabilities, experience, and diversity to our Board. Incumbent Nominations The Nominating and Corporate Governance Committee supervises the nomination process for directors. The committee considers the performance, independence, diversity, and other characteristics of our incumbent directors, including their willingness to serve for an additional term, and any change in their employment or other circumstances in considering their renomination each year. Identification and Consideration of New Nominees In the event that a vacancy exists, or we decide to increase the size of the Board, we identify, interview and examine, and make recommendations to the Board regarding appropriate candidates. We will consider Board members with diverse capabilities, and we generally look for Board members with capabilities in one or more of the following areas: accounting and financial reporting, financial services and money management, investments, general economics and industry oversight, legal, government affairs and corporate governance, general management, international, marketing and distribution, and technology and facilities management. In evaluating potential candidates, we consider independence from management, background, experience, expertise, commitment, diversity, number of other public board and related committee seats held, and potential conflicts of interest, among other factors, and take into account the composition of the Board at the time of the assessment. All candidates for nomination must: demonstrate unimpeachable character and integrity; have sufficient time to carry out their duties; have experience at senior levels in areas of expertise helpful to the Company and consistent with the objective of having a diverse and well-rounded Board; and | • | have the willingness and commitment to assume the responsibilities required of a director of the Company. |

In addition, candidates expected to serve on the Audit Committee must meet independence and financial literacy qualifications imposed by the NASDAQ Global Select Market and by the SEC and other applicable law. Candidates expected to serve on this committee or the Compensation Committee must meet independence qualifications set out by the NASDAQ Global Select Market, and members of the Compensation Committee must also meet additional independence tests imposed by the NASDAQ Global Select Market. Our evaluations of potential directors include, among other things, an assessment of a candidate’s background and credentials, personal interviews, and discussions with appropriate references. Once we have selected a candidate, we present him or her to the full Board for election if a vacancy occurs or is created by an increase in the size of the Board during the course of the year, or for nomination if the director is to be first elected by the Company’s stockholders. All directors serve for one-year terms and must stand for reelection annually.

| Identification of Candidates | The Nominating and Corporate Governance Committee identifies, interviews and examines, and makes recommendations to the Board regarding appropriate candidates. The Nominating and Corporate Governance Committee identifies potential candidates principally through the following: • Consideration of incumbent directors • Suggestions from the Company’s directors and senior management • Third parties/national search organization • Candidates recommended or suggested by stockholders | | Evaluation of Candidates | The Nominating and Corporate Governance Committee’s evaluations of potential directors include the following: • An assessment of a candidate’s background and credentials • Personal interviews • Discussions with appropriate references | | Election of Candidates | Once the Nominating and Corporate Governance Committee has selected a candidate, the candidate is presented to the full Board for election if a vacancy occurs or is created by an increase in the size of the Board during the course of the year, or for nomination if the director is to be first elected by the Company’s stockholders. |

Stockholder Recommendations and Nominations Recommendations A stockholder who wishes to recommend a candidate for the Board should send a letter to the chair of the ManagementNominating and Corporate Governance Committee at the Company’s principal executive offices providing: (i) information relevant to the candidate’s satisfaction of the criteria described above under “Director Nomination Process”; and (ii) information that would be required for a director nomination under Section 1.11 of the Company’s Amended and Restated By-Laws (By-Laws). The Nominating and Corporate Governance Committee will consider and evaluate candidates recommended by stockholders in the same manner it considers candidates from other senior officerssources. Acceptance of a recommendation does not imply that the Nominating and Corporate Governance Committee will ultimately nominate the recommended candidate. Proxy Access and Nominations We have adopted a proxy access right to permit a stockholder, or a group of up to 20 stockholders, owning 3% or more of the Company’s outstanding common stock continuously for at least three years, to nominate and include in the Company’s proxy materials director-nominees constituting up to two individuals or 20% of the Board (whichever is greater), provided that the stockholder(s) and the nominee(s) satisfy the requirements specified in the By-Laws. Section 1.13 of the By-Laws sets out the procedures a stockholder must follow to use proxy access. Section 1.11 of the By-Laws sets out the procedures a stockholder must follow in order to nominate a candidate for Board membership outside of the proxy access process. For these requirements, please refer to the By-Laws as of February 9, 2021, filed with the SEC on February 11, 2021, as Exhibit 3.1 to our Annual Report on Form 10-K. Majority Voting We have adopted a majority voting standard for the election of our directors. Under our By-Laws, in an uncontested election, a nominee will not be elected unless he or she receives more “FOR” votes than “AGAINST” votes. Under Maryland law, any incumbent director not so elected would continue in office as a “holdover” director until removed or replaced. As a result, the By-Laws also provide that any director who fails to obtain the required vote in an uncontested election must submit his or her resignation to the Board. The Board must decide whether to accept or decline the resignation, or decline the resignation with conditions, taking into consideration the Nominating and Corporate Governance Committee’s recommendation after consideration of all factors deemed relevant, within 90 days after the vote has been certified. Plurality voting will apply to contested elections. Board Leadership Chair of the Board and Lead Independent Director  | | |  | William J. Stromberg

Chair of the Board | | | Alan D. Wilson

Lead Independent Director | | | | | Mr. Stromberg was elected as the chair of the Board in addition to his role as our President and CEO at the April 2019 Board meeting. By serving in both positions, Mr. Stromberg has been able to draw on his detailed knowledge of the Company to provide leadership to the Board in coordination with the lead independent director. The combined role of chair and CEO reflects our confidence in the leadership of Mr. Stromberg and also ensures that the Company presents its strategy to clients, employees and stockholders with a unified voice from the person most knowledgeable about and responsible for the implementation of the Company’s strategy. | | | Mr. Wilson was elected by our independent directors as lead independent director after the 2018 Annual Meeting and is expected to be re-elected after the Annual Meeting. The lead independent director role was created in 2004 and has continually developed since that time. The lead independent director chairs Board meetings at which the chair is not present, approves Board agendas and meeting schedules, and oversees Board materials distributed in advance of Board meetings. The lead independent director also calls meetings of the independent directors, chairs all executive sessions of the independent directors, and acts as liaison between the independent directors and management. The lead independent director is available to the general counsel and corporate secretary to discuss and, as necessary, respond to stockholder communications to the Board. Mr. Wilson’s significant executive management experience, including having served as chair and chief executive officer of a publicly traded company, makes him especially qualified to serve as the lead independent director for the Board. |

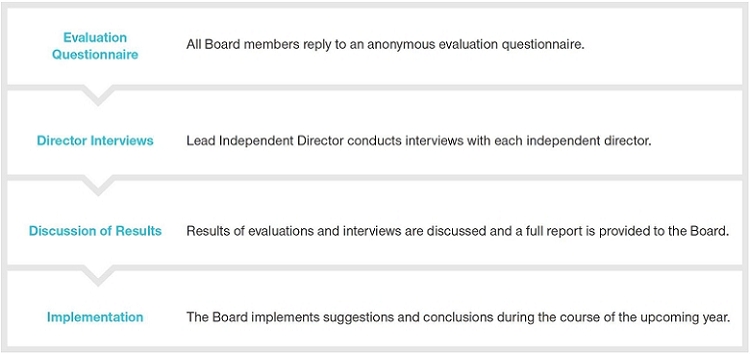

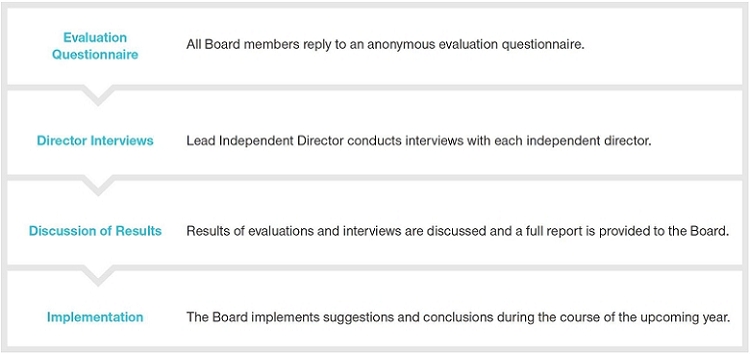

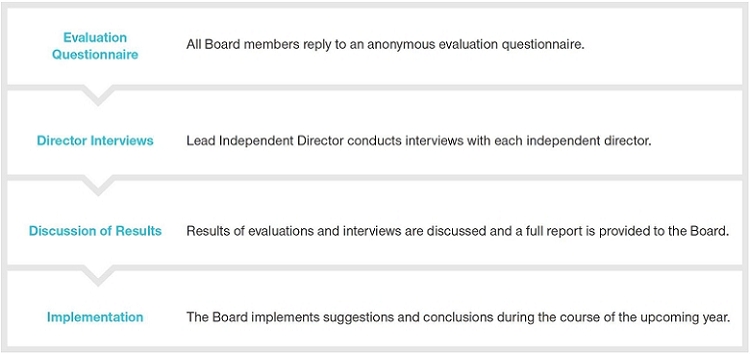

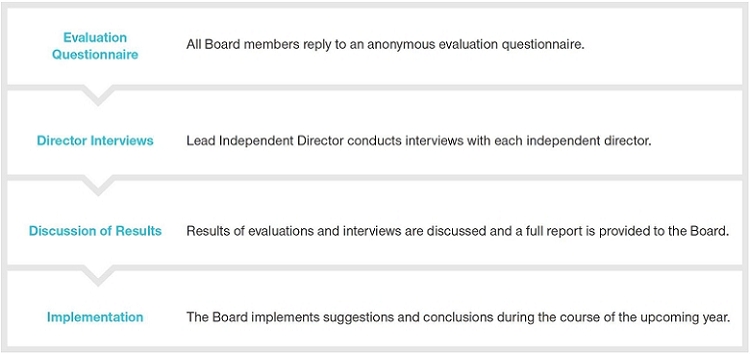

Independent Leadership The Board has determined that the election of a lead independent director, together with a combined chair and CEO, serve the best interests of the Company and its stockholders at this time. We believe that a well-empowered lead independent director provides independent leadership to our Board. The Company has a strong independent Board, and all of the members of the Board, other than Mr. Stromberg, are also members. independent under the NASDAQ Global Select Market standards. In addition, the Nominating and Corporate Governance Committee, the Audit Committee, and the Compensation Committee are all composed entirely of independent directors, and our chair and lead independent director, together with these committees, have significant and meaningful responsibilities designed to foster critical oversight and good governance practices. We believe that our structure is appropriate at this time and serves well the interests of the Company and its stockholders. The Management Board is confident that the duties and responsibilities allocated to its lead independent director, together with its other corporate governance practices and strong independent board, provides appropriate and effective independent oversight of management. Committee reportsLeadership and Rotation In 2015, Mr. Bartlett became the chair of the Audit Committee, Mr. MacLellan became the chair of the Compensation Committee and Ms. Snowe became the chair of the Nominating and Corporate Governance Committee. Our Corporate Governance Guidelines provide that periodic rotation of committee membership and chairpersons is generally beneficial to the Company, and contributes to healthy and collaborative Board engagement. However, this rotation is not mandatory, and in some circumstances continued service on a committee or as chair by persons with particular skills may be warranted. At least every 5 years, the Nominating and Corporate Governance Committee shall do a thorough review of all Board leadership positions to make recommendations to the Board about potential changes and to suggest skills which may be needed on the management and operationcommittees. Board Evaluations In January 2021, we asked all Board members to reply to an anonymous evaluation questionnaire regarding the performance of the Board and its committees during 2020, which evaluation was conducted by an outside third-party in consultation with the Chair of the Nominating and Corporate Governance Committee and the Lead Independent Director. Feedback from these questionnaires was supplemented by interviews of each independent director by our Lead Independent Director. The results of the evaluations and interviews were then discussed at a meeting of the Nominating and Corporate Governance Committee and a full report was also provided to the Board. Consistent with past practice, we consider suggestions from the evaluation process for inclusion during the course of the upcoming year. We plan to continue to conduct independent third-party evaluations and interviews each year and to periodically modify our procedures to ensure that we receive candid feedback and are responsive to future developments and suggestions from our directors.

Engagement with our Stockholders As investment professionals, we know the value of engaging with companies. We maintain an active and open dialogue with our stockholders, visiting them in their cities, hosting them in our offices, and inviting them to our annual meeting of stockholders. We proactively engage them on a range of topics including corporate governance, and our philosophy and practices relating to environmental and social responsibility. We attempt to incorporate and address the feedback we receive from our stockholders into our practices. The work-from-home environment as a result of the coronavirus pandemic created new opportunities to engage our stockholders in 2020. We held nearly 100 meetings with our stockholders in the virtual environment, including a majority of our top 40 stockholders, to discuss the Company’s performance and progress against our long-term strategy, as well as broader trends across the investment management industry. Further, in an effort to provide greater transparency around our efforts and progress related to our environmental, social and governance initiatives, we also published our first-ever Corporate ESG Update for Stockholders. We look forward to continuing to expand our stockholder engagement efforts. | HOW | | WHAT | • Attendance at Conferences • Investor Day • Incoming stockholder calls and meetings • Annual Meeting of Stockholders • Outreach, calls and meetings with Investors’ corporate governance departments • Participation on industry panels • Universal access to an email address for stockholders wishing to contact the Board | | • Strategic and financial performance and goals • Corporate and business strategy • Board composition and leadership structure • Corporate governance and industry trends, including ESG considerations • Regulatory considerations • Respond to inquiries concerning broad range of topics |

Stockholder Proposals From time to time, we receive proposals from our stockholders intended for inclusion in our proxy statement. We typically work with Company through Mr. Stromberg. Asmanagement in reviewing these proposals and determining an appropriate course of March 14, 2019, currentaction in response, including, where necessary, a statement of our position for or in opposition to the proposal from the stockholder. Often in response the Board will ask management to engage with a stockholder on their proposal, which has led to meaningful dialogue and assisted the Board in understanding the concerns of our stockholders. Stockholder Communications with the Board of Directors Our Board members are interested in hearing the opinions of the stockholders. The Nominating and Corporate Governance Committee has established the following procedures in order to facilitate communications between our stockholders and our Board: | • | Stockholders may send correspondence, which should indicate that the sender is a stockholder, to our Board or to any individual director by mail to T. Rowe Price Group, Inc., c/o general counsel, P.O. Box 17134, Baltimore, MD 21297-1134, or by email to contact_the_board@troweprice.com or by Internet at troweprice.gcs-web.com/corporate-governance/contact-the-board. | | | | • | Our general counsel will be responsible for the first review and logging of this correspondence. The general counsel will forward the communication to the director or directors to whom it is addressed unless it is a type of correspondence that the Nominating and Corporate Governance Committee has identified as correspondence that may be retained in our files and not sent to directors. | | | | • | The Nominating and Corporate Governance Committee has authorized the general counsel to retain and not send to directors the following types of communications: |

| • | Advertising or promotional in nature (offering goods or services); | | | | | • | Complaints by clients with respect to ordinary course of business customer service and satisfaction issues; provided, however, that the general counsel will notify the chair of the Nominating and Corporate Governance Committee of any complaints that, in the opinion of the general counsel, warrant immediate committee attention by their nature or frequency; or | | | | | • | Those clearly unrelated to our business, industry, management, Board, or committee matters. |

These types of communications will be logged and filed but not circulated to directors. Except as described above, the general counsel will not screen communications sent to directors. The log of stockholder correspondence will be available to members of the ManagementNominating and Corporate Governance Committee include: Christopher D. Alderson, co-head of global equity; Scott B. David, head of individual and retirement plan services; Cèline S. Dufétel, chief financial officer and treasurer; Nigel K. Faulkner, head of global technology; Robert C.T. Higginbotham, head of global investment management services; Andrew C. McCormick, head of fixed income; David Oestreicher, chief legalfor inspection. At least once each year, the general counsel and corporate secretary; Sebastien Page, head of global multi-asset; Dorothy C. “Dee” Sawyer, head of human resources; Robert W. Sharps, head of investments and group chief investment officer; and Eric L. Veiel, co-head of global equity. Each of these members brings extensive experience and wisdomwill provide to the managementNominating and leadershipCorporate Governance Committee a summary of the Company.communications received from stockholders, including the communications not sent to directors in accordance with screening procedures approved by the Nominating and Corporate Governance Committee. By the Nominating and Corporate Governance Committee of the

Board of Directors of T. Rowe Price Group, Inc. | Olympia J. Snowe, Chair

Mary K. Bush

Dr. Freeman A. Hrabowski, III

Robert J. Stevens

Alan D. Wilson |

Compensation of Directors The Nominating and Corporate Governance Committee is responsible for periodically reviewing non-employee director compensation and benefits and recommending changes, if appropriate, to the full Board. Our non-employee director compensation program is designed to accomplish a number of objectives: | ■ | Align the interests of our non-employee directors with those of our stockholders; |

Align the interests of our non-employee directors with those of our stockholders; | ■ | Provide competitive compensation for service to the Board by our non-employee directors; |

Provide competitive compensation for service to the Board by our non-employee directors; | ■ | Maintain appropriate consistency with our approach to compensation for our executive officers and senior employees; and |

Maintain appropriate consistency with our approach to compensation for our executive officers and senior employees; and | ■ | Attract and retain a diverse mix of capable and highly qualified directors. |

Attract and retain a diverse mix of capable and highly qualified directors. We provide both cash and equity compensation to our directors and believe that, over time, cash and equity compensation should reflect approximately 40% and 60%, respectively, of the total compensation paid to our directors. The cash compensation component is based primarily on an annual retainer coupled with fees for committee attendance, lead director role, and committee chair roles. The equity compensation component is in the form of full value awards. We believe our total compensation package and compensation structure is comparable to and in line with other major financial service companies. The Nominating and Corporate Governance Committee periodically reviews and considers competitive market practices. In 20182020 there were no changes to the compensation program for our non-employee directors. Fees and Other Compensation in 20182020 All non-employee directors received the following in 2018:2020: | ■ | An annual retainer of $100,000 for all non-employee directors; |

An annual retainer of $100,000 for all non-employee directors; | ■ | A fee of $1,500 for each committee meeting attended; |

A fee of $1,500 for each committee meeting attended; | ■ | A fee of $15,000 for the lead director; |

A fee of $15,000 for the lead director; | ■ | A fee of $20,000 and $5,000, for the chair of the Audit Committee and each Audit Committee member, respectively; |

A fee of $20,000 and $5,000, for the chair of the Audit Committee and each Audit Committee member, respectively; | ■ | A fee of $10,000 for the chair of the Compensation Committee; |

A fee of $10,000 for the chair of the Compensation Committee; | ■ | A fee of $10,000 for the chair of the Nominating and Corporate Governance Committee; |

A fee of $10,000 for the chair of the Nominating and Corporate Governance Committee; | ■ | Directors and all U.S. employees of Price Group and its subsidiaries are eligible to have our sponsored T. Rowe Price Foundation match personal gifts up to an annual limit to qualified charitable organizations. For 2018, non-employee directors were eligible to have up to $10,000 matched; |

| ■ | The reimbursement of reasonable out-of-pocket expenses incurred in connection with their travel to and from, and attendance at each meeting of the Board and its committees and related activities, including director education courses and materials; |

| ■ | The reimbursement of spousal travel to and from and participation in events held in connection with the annual joint Price Group and Price funds’ boards of directors meeting; and |

14 T. ROWE PRICE GROUP

Rowe Price Foundation match personal gifts up to an annual limit to qualified charitable organizations. For 2020, non-employee directors were eligible to have up to $10,000 matched;TABLE OF CONTENTS

| ■ | In addition to the $100,000 annual retainer fee as a non-employee director and the other compensation described above, Mr. Rogers received a fee of $100,000 for his role as the nonexecutive chair of the Board. |

The reimbursement of reasonable out-of-pocket expenses incurred in connection with their travel to and from, and attendance at each meeting of the Board and its committees and related activities, including director education courses and materials; andThe reimbursement of spousal travel to and from and participation in events held in connection with the annual joint Price Group and Price funds’ boards of directors meeting. The annual retainer and fees noted above are prorated for the period of time during the calendar year that each director held the position. Pursuant to the Outside Directors Deferred Compensation Plan, non-employee directors can elect to defer payment of their director fees until the next calendar year.year or to defer payment of their director fees into vested restricted stock units (RSUs) pursuant to the 2017 Non-Employee Director Equity Plan, as amended (2017 Director Plan). The RSUs will be settled in shares of our common stock, or cash in the case of fractional shares, upon the director’s separation from service. Any such election needs to be received prior to the beginning of the year they wish to have their payment deferred. Dr. Hrabowski and Ms. Snowe and Mr. Wilson elected to have their 20182020 director fees deferred to 2019.2021. Messrs. MacLellan, Stevens, Wilson and Ms. Wijnberg elected to have their 2020 director fees deferred into vested RSUs. Equity-Based Compensation in 20182020 Pursuant to the 2017 Non-Employee Director Equity Plan, (2017 Director Plan) approved by the stockholders on April 26, 2017, each newly elected Board member is awarded an initial grant in the form, at their election, of restricted shares or restricted stock units (RSUs)RSUs having a value on the date of grant of $300,000 that vests one-year after the grant date. In each subsequent year, each non-employee director except Mr. Rogers, is awarded, at their election, restricted shares or RSUs having a value on the date of grant of $200,000 on the first business day after the Annual Meeting. For Mr. Rogers, the Committee determined that, in light of his already significant stock ownership, they would pay him a cash amount of $200,000 in lieu of participating in the annual equity award provided to other non-employee directors. Each of the award types vest upon the earliest of the non-employee director’s death or date on which the director becomes totally and permanently disabled, one year after the grant date, or the day before the annual meeting held in the calendar year after the year in which the grant is made, the non-employee director’s death or date on which the director becomes totally and permanently disabled, or the date on which a change in control occurs, provided the director continues to be a member of the Board on the applicable date. Restricted shares entitle the holder to the rights of a stockholder, including voting, dividend, and distribution rights, but are nontransferable until they vest. Vested stock units will be settled in shares of our common stock or cash, in the case of fractional shares, upon a non-employee director’s separation from service. Non-employee directors holding stock units are not entitled to voting, dividend, distribution, or other rights until the corresponding shares of our common stock are issued upon settlement; however, if and when we pay a cash dividend to our common stockholders, we will issue dividend equivalents in the form of additional stock units. Under the 2017 Director Plan, dividends and dividend equivalents payable with respect to unvested restricted shares and unvested stock units will be subject to the same vesting and risks of forfeiture as the restricted shares and stock units to which they are attributable. The 2017 Director Plan includes a provision that accelerates the vesting of all outstanding awards in connection with a change in control of Price Group. Upon a change in control, any outstanding stock units will be settled in cash or shares at the discretion of the Board. Ownership and Retention GuidelinesBoard Leadership

Each non-employee director added to the Board in 2015 or 2016 is required to hold shares

Chair of our common stock having a value equal to $300,000 within five years of the director’s appointment to the Board and directors added to the Board prior to 2015 have an ownership goal of $225,000 (in each case an amount equal to three (3) times the applicable cash retainer at the time of appointment). Directors who were new to the Board in 2017 or who will join in the future, have an ownership goal of five times the annual cash retainer in effect on the date they join the Board. For purposes of the calculation, unvested restricted shares and outstanding stock units are counted, but unexercised stock options are not. Once this ownership goal is achieved, the number of shares required to be held becomes fixed and must be maintained until the end of the director’s service on the Board. Until the ownership goal is achieved, the director is expected to retain “net gain shares” resulting from the exercise of stock options or vesting of restricted stock granted under the applicable director plan. Net gain shares are the shares remaining after payment of the stock option exercise price and taxes owed with respect to the exercise or vesting event. In addition, net gain shares realized under the applicable director plan after the ownership goal is achieved are expected to be held for two years prior to sale or other transfer, but not beyond the end of the director’s service on the Board. All of our directors, other than Mr. Verma who joined the Board in 2018, have achieved and maintain the ownership goal as of the date of this proxy statement. PROXY STATEMENT 2019 15

Lead Independent Director

TABLE OF CONTENTS

2018 Director Compensation1

The following table sets forth information regarding the compensation earned by, or paid to, directors who served on our Board during 2018. Directors who are also officers of Price Group do not receive separate directors’ fees and have been omitted from this table. Mr. Stromberg and Mr. Bernard appear in our Summary Compensation Table as named executive officers.

Name | Fees Earned

or Paid

in Cash | Stock

Awards4,5 | All Other

Compensation6 | Total | | Mark S. Bartlett | $ | 141,000 | | $ | 200,105 | | $ | 10,000 | | $ | 351,105 | | Mary K. Bush | $ | 118,000 | | $ | 237,533 | | $ | 10,000 | | $ | 365,533 | | H. Lawrence Culp, Jr.2 | $ | 92,333 | | $ | 200,105 | | $ | — | | $ | 292,438 | | Dr. Freeman A. Hrabowski, III | $ | 126,000 | | $ | 225,796 | | $ | 10,000 | | $ | 361,796 | | Robert F. MacLellan | $ | 136,000 | | $ | 214,186 | | $ | 10,000 | | $ | 360,186 | | Brian C. Rogers | $ | 400,000 | | $ | — | | $ | 10,000 | | $ | 410,000 | | Olympia J. Snowe | $ | 128,000 | | $ | 219,659 | | $ | 10,000 | | $ | 357,659 | | Dwight Taylor3 | $ | 42,500 | | $ | — | | $ | — | | $ | 42,500 | | Richard R. Verma3 | $ | 90,750 | | $ | 305,662 | | $ | — | | $ | 396,412 | | Anne Marie Whittemore3 | $ | 44,333 | | $ | — | | $ | — | | $ | 44,333 | | Sandra S. Wijnberg | $ | 126,000 | | $ | 212,836 | | $ | 10,000 | | $ | 348,836 | | Alan D. Wilson | $ | 129,250 | | $ | 232,882 | | $ | 10,000 | | $ | 372,132 | |

| 1 | Includes only those columns relating to compensation awarded to, earned by, or paid to non-employee directors for their services in 2018. All other columns have been omitted. |  |

| 2 | Mr. Culp was paid fees for partWilliam J. Stromberg

Chair of the year until he resigned fromBoard | | | Alan D. Wilson

Lead Independent Director | | | | | Mr. Stromberg was elected as the Board in October 2018. The amount in the stock award column represents the grant date fair value of the annual award made in April 2018 that was forfeited under the terms of the grant agreement upon Mr. Culp’s resignation from the Board. |

| 3 | The fees earned by Mr. Taylor, Mr. Verma, and Ms. Whittemore represent pro-rata amounts for the time they were memberschair of the Board in 2018. |

| 4 | The following table representsaddition to his role as our President and CEO at the equity awards grantedApril 2019 Board meeting. By serving in 2018both positions, Mr. Stromberg has been able to certaindraw on his detailed knowledge of the non-employee directors named above. In accordanceCompany to provide leadership to the Board in coordination with the 2017 Director Plan, each non-employee director was awarded a grant date valuelead independent director. The combined role of $200,000, exceptchair and CEO reflects our confidence in the leadership of Mr. Verma who received an awardStromberg and also ensures that the Company presents its strategy to clients, employees and stockholders with a grant date value of $300,000 as a newly elected director. The equity value was converted to awards or units, usingunified voice from the closing stock price of our common stock onperson most knowledgeable about and responsible for the date of grant. Fractional shares were rounded up to the nearest whole share. The holders of RSUs also receive dividend equivalents in the form of additional vested stock units on eachimplementation of the Company’s dividend payment dates. Fractional shares earnedstrategy. | | | Mr. Wilson was elected by our independent directors as dividend equivalents have been roundedlead independent director after the 2018 Annual Meeting and is expected to be re-elected after the Annual Meeting. The lead independent director role was created in 2004 and has continually developed since that time. The lead independent director chairs Board meetings at which the chair is not present, approves Board agendas and meeting schedules, and oversees Board materials distributed in advance of Board meetings. The lead independent director also calls meetings of the independent directors, chairs all executive sessions of the independent directors, and acts as liaison between the independent directors and management. The lead independent director is available to the nearest whole share. |

Director | Grant Date | Number of

Restricted

Shares | Number of

Restricted

Units | Grant Date Fair

Value of Stock

and Option

Awards | Mark S. Bartlett | | 4/27/2018 | | | 1,755 | | | | | $ | 200,105 | | Mary K. Bush | | 3/29/2018 | | | | | | 86 | | $ | 9,269 | | | | 4/27/2018 | | | 1,755 | | | | | $ | 200,105 | | | | 6/29/2018 | | | | | | 80 | | $ | 9,329 | | | | 9/28/2018 | | | | | | 86 | | $ | 9,385 | | | | 12/28/2018 | | | | | | 103 | | $ | 9,445 | | H. Lawrence Culp, Jr. | | 4/27/2018 | | | 1,755 | | | | | $ | 200,105 | | Dr. Freeman A. Hrabowski, III | | 3/29/2018 | | | | | | 50 | | $ | 5,444 | | | | 4/27/2018 | | | | | | 1,755 | | $ | 200,105 | | | | 6/29/2018 | | | | | | 58 | | $ | 6,708 | | | | 9/28/2018 | | | | | | 62 | | $ | 6,748 | | | | 12/28/2018 | | | | | | 74 | | $ | 6,791 | | Robert F. MacLellan | | 3/29/2018 | | | | | | 32 | | $ | 3,487 | | | | 4/27/2018 | | | 1,755 | | | | | $ | 200,105 | | | | 6/29/2018 | | | | | | 30 | | $ | 3,510 | | | | 9/28/2018 | | | | | | 32 | | $ | 3,531 | | | | 12/28/2018 | | | | | | 39 | | $ | 3,553 | | Olympia J. Snowe | | 3/29/2018 | | | | | | 36 | | $ | 3,924 | | | | 4/27/2018 | | | | | | 1,755 | | $ | 200,105 | | | | 6/29/2018 | | | | | | 45 | | $ | 5,178 | | | | 9/28/2018 | | | | | | 48 | | $ | 5,209 | | | | 12/28/2018 | | | | | | 57 | | $ | 5,243 | |

TABLE OF CONTENTS

Director | Grant Date | Number of

Restricted

Shares | Number of

Restricted

Units | Grant Date Fair

Value of Stock

and Option

Awards | Richard R. Verma | | 4/27/2018 | | | | | | 2,632 | | $ | 300,101 | | | | 6/29/2018 | | | | | | 16 | | $ | 1,842 | | | | 9/28/2018 | | | | | | 17 | | $ | 1,854 | | | | 12/28/2018 | | | | | | 20 | | $ | 1,865 | | Sandra S. Wijnberg | | 3/29/2018 | | | | | | 29 | | $ | 3,153 | | | | 4/27/2018 | | | 1,755 | | | | | $ | 200,105 | | | | 6/29/2018 | | | | | | 27 | | $ | 3,173 | | | | 9/28/2018 | | | | | | 29 | | $ | 3,192 | | | | 12/28/2018 | | | | | | 35 | | $ | 3,213 | | Alan D. Wilson | | 3/29/2018 | | | | | | 67 | | $ | 7,199 | | | | 4/27/2018 | | | | | | 1,755 | | $ | 200,105 | | | | 6/29/2018 | | | | | | 73 | | $ | 8,474 | | | | 9/28/2018 | | | | | | 78 | | $ | 8,525 | | | | 12/28/2018 | | | | | | 94 | | $ | 8,579 | |

| 5 | The following table representsgeneral counsel and corporate secretary to discuss and, as necessary, respond to stockholder communications to the aggregate number of equity awards outstandingBoard.Mr. Wilson’s significant executive management experience, including having served as of December 31, 2018. The outstanding equity awards held by Mr. Rogers were granted while he was anchair and chief executive officer of a publicly traded company, makes him especially qualified to serve as the Company. Mr. Culp’s unexercised option awards expire five years following his resignation fromlead independent director for the Board. |

Director | Unvested

Stock Awards | Unvested

Stock Units | Unexercised

Option Awards | Total | Vested Stock

Units | Mark S. Bartlett | | 1,755 | | | | | | | | | 1,755 | | | | | Mary K. Bush | | 1,755 | | | | | | | | | 1,755 | | | 13,597 | | H. Lawrence Culp, Jr. | | | | | | | | 8,700 | | | 8,700 | | | | | Dr. Freeman A. Hrabowski, III | | | | | 1,791 | | | 26,008 | | | 27,799 | | | 7,986 | | Robert F. MacLellan | | 1,755 | | | | | | 42,942 | | | 44,697 | | | 5,115 | | Brian C. Rogers | | | | | 4,260 | | | 132,462 | | | 136,722 | | | | | Olympia J. Snowe | | | | | 1,791 | | | | | | 1,791 | | | 5,757 | | Richard R. Verma | | | | | 2,685 | | | | | | 2,685 | | | | | Sandra S. Wijnberg | | 1,755 | | | | | | | | | 1,755 | | | 4,625 | | Alan D. Wilson | | | | | 1,791 | | | | | | 1,791 | | | 10,560 | |

Independent Leadership The Board has determined that the election of a lead independent director, together with a combined chair and CEO, serve the best interests of the Company and its stockholders at this time. We believe that a well-empowered lead independent director provides independent leadership to our Board. The Company has a strong independent Board, and all of the members of the Board, other than Mr. Stromberg, are independent under the NASDAQ Global Select Market standards. In addition, the Nominating and Corporate Governance Committee, the Audit Committee, and the Compensation Committee are all composed entirely of independent directors, and our chair and lead independent director, together with these committees, have significant and meaningful responsibilities designed to foster critical oversight and good governance practices. We believe that our structure is appropriate at this time and serves well the interests of the Company and its stockholders. | 24 | 6 | Personal gifts matched by our sponsored T. Rowe Price Foundation to qualified charitable organizations.Group |

Report

The Board is confident that the duties and responsibilities allocated to its lead independent director, together with its other corporate governance practices and strong independent board, provides appropriate and effective independent oversight of management. Committee Leadership and Rotation In 2015, Mr. Bartlett became the chair of the Audit Committee, Mr. MacLellan became the chair of the Compensation Committee and Ms. Snowe became the chair of the Nominating and Corporate Governance Committee. Our Corporate Governance Guidelines provide that periodic rotation of committee membership and chairpersons is generally beneficial to the Company, and contributes to healthy and collaborative Board engagement. However, this rotation is not mandatory, and in some circumstances continued service on a committee or as chair by persons with particular skills may be warranted. At least every 5 years, the Nominating and Corporate Governance Committee shall do a thorough review of all Board leadership positions to make recommendations to the Board about potential changes and to suggest skills which may be needed on the committees. Board Evaluations In January 2021, we asked all Board members to reply to an anonymous evaluation questionnaire regarding the performance of the Board and its committees during 2020, which evaluation was conducted by an outside third-party in consultation with the Chair of the Nominating and Corporate Governance Committee and the Lead Independent Director. Feedback from these questionnaires was supplemented by interviews of each independent director by our Lead Independent Director. The results of the evaluations and interviews were then discussed at a meeting of the Nominating and Corporate Governance Committee and a full report was also provided to the Board. Consistent with past practice, we consider suggestions from the evaluation process for inclusion during the course of the upcoming year. We plan to continue to conduct independent third-party evaluations and interviews each year and to periodically modify our procedures to ensure that we receive candid feedback and are responsive to future developments and suggestions from our directors.

Engagement with our Stockholders As investment professionals, we know the value of engaging with companies. We maintain an active and open dialogue with our stockholders, visiting them in their cities, hosting them in our offices, and inviting them to our annual meeting of stockholders. We proactively engage them on a range of topics including corporate governance, and our philosophy and practices relating to environmental and social responsibility. We attempt to incorporate and address the feedback we receive from our stockholders into our practices. The work-from-home environment as a result of the coronavirus pandemic created new opportunities to engage our stockholders in 2020. We held nearly 100 meetings with our stockholders in the virtual environment, including a majority of our top 40 stockholders, to discuss the Company’s performance and progress against our long-term strategy, as well as broader trends across the investment management industry. Further, in an effort to provide greater transparency around our efforts and progress related to our environmental, social and governance initiatives, we also published our first-ever Corporate ESG Update for Stockholders. We look forward to continuing to expand our stockholder engagement efforts. | HOW | | WHAT | • Attendance at Conferences • Investor Day • Incoming stockholder calls and meetings • Annual Meeting of Stockholders • Outreach, calls and meetings with Investors’ corporate governance departments • Participation on industry panels • Universal access to an email address for stockholders wishing to contact the Board | | • Strategic and financial performance and goals • Corporate and business strategy • Board composition and leadership structure • Corporate governance and industry trends, including ESG considerations • Regulatory considerations • Respond to inquiries concerning broad range of topics |

Stockholder Proposals From time to time, we receive proposals from our stockholders intended for inclusion in our proxy statement. We typically work with Company management in reviewing these proposals and determining an appropriate course of action in response, including, where necessary, a statement of our position for or in opposition to the proposal from the stockholder. Often in response the Board will ask management to engage with a stockholder on their proposal, which has led to meaningful dialogue and assisted the Board in understanding the concerns of our stockholders. Stockholder Communications with the Board of Directors Our Board members are interested in hearing the opinions of the stockholders. The Nominating and Corporate Governance Committee has established the following procedures in order to facilitate communications between our stockholders and our Board: | • | Stockholders may send correspondence, which should indicate that the sender is a stockholder, to our Board or to any individual director by mail to T. Rowe Price Group, Inc., c/o general counsel, P.O. Box 17134, Baltimore, MD 21297-1134, or by email to contact_the_board@troweprice.com or by Internet at troweprice.gcs-web.com/corporate-governance/contact-the-board. | | | | • | Our general counsel will be responsible for the first review and logging of this correspondence. The general counsel will forward the communication to the director or directors to whom it is addressed unless it is a type of correspondence that the Nominating and Corporate Governance Committee has identified as correspondence that may be retained in our files and not sent to directors. | | | | • | The Nominating and Corporate Governance Committee has authorized the general counsel to retain and not send to directors the following types of communications: |

| • | Advertising or promotional in nature (offering goods or services); | | | | | • | Complaints by clients with respect to ordinary course of business customer service and satisfaction issues; provided, however, that the general counsel will notify the chair of the Nominating and Corporate Governance Committee of any complaints that, in the opinion of the general counsel, warrant immediate committee attention by their nature or frequency; or | | | | | • | Those clearly unrelated to our business, industry, management, Board, or committee matters. |

These types of communications will be logged and filed but not circulated to directors. Except as described above, the general oversight responsibility for governancecounsel will not screen communications sent to directors. The log of the Company, including the assessment and recruitment of new director candidates and the evaluation of director and Board performance. We monitor regulatory and other developments in the governance area with a view toward both legal compliance and maintaining governance practices at the Company consistent with what we considerstockholder correspondence will be available to be best practices. In this regard, we routinely receive written and verbal information relating to best governance practices for institutions such as the Company, including input and reports from members of the Company’s proxy voting group concerning relevant trendsNominating and Corporate Governance Committee for inspection. At least once each year, the general counsel will provide to the Nominating and Corporate Governance Committee a summary of the communications received from stockholders, including the communications not sent to directors in accordance with screening procedures approved by the Nominating and Corporate Governance Committee. By the Nominating and Corporate Governance Committee of the

Board of Directors of T. Rowe Price Group, Inc. | Olympia J. Snowe, Chair

Mary K. Bush

Dr. Freeman A. Hrabowski, III

Robert J. Stevens

Alan D. Wilson |

Compensation of Directors The Nominating and Corporate Governance Committee is responsible for periodically reviewing non-employee director compensation and benefits and recommending changes, if appropriate, to the full Board. Our non-employee director compensation program is designed to accomplish a number of objectives: Align the interests of our non-employee directors with those of our stockholders; Provide competitive compensation for service to the Board by our non-employee directors; Maintain appropriate consistency with our approach to compensation for our executive officers and senior employees; and Attract and retain a diverse mix of capable and highly qualified directors. We provide both cash and equity compensation to our directors and believe that, over time, cash and equity compensation should reflect approximately 40% and 60%, respectively, of the total compensation paid to our directors. The cash compensation component is based primarily on an annual retainer coupled with fees for committee attendance, lead director role, and committee chair roles. The equity compensation component is in the form of full value awards. We believe our total compensation package and compensation structure is comparable to and in line with other major financial service companies. The Nominating and Corporate Governance Committee periodically reviews and considers competitive market practices. In 2018,2020 there were no changes to the compensation program for our non-employee directors. Fees and Other Compensation in 2020 All non-employee directors received the following in 2020: An annual retainer of $100,000 for all non-employee directors; A fee of $1,500 for each committee meeting attended; A fee of $15,000 for the lead director; A fee of $20,000 and $5,000, for the chair of the Audit Committee and each Audit Committee member, respectively; A fee of $10,000 for the chair of the Compensation Committee; A fee of $10,000 for the chair of the Nominating and Corporate Governance Committee; Directors and all U.S. employees of Price Group and its subsidiaries are eligible to have our sponsored T. Rowe Price Foundation match personal gifts up to an annual limit to qualified charitable organizations. For 2020, non-employee directors were eligible to have up to $10,000 matched; The reimbursement of reasonable out-of-pocket expenses incurred in connection with their travel to and from, and attendance at each meeting of the Board and its committees and related activities, including director education courses and materials; and The reimbursement of spousal travel to and from and participation in events held in connection with the annual joint Price Group and Price funds’ boards of directors meeting. The annual retainer and fees noted above are prorated for the period of time during the calendar year that each director held the position. Pursuant to the Outside Directors Deferred Compensation Plan, non-employee directors can elect to defer payment of their director fees until the next calendar year or to defer payment of their director fees into vested restricted stock units (RSUs) pursuant to the 2017 Non-Employee Director Equity Plan, as amended (2017 Director Plan). The RSUs will be settled in shares of our common stock, or cash in the case of fractional shares, upon the director’s separation from service. Any such election needs to be received prior to the beginning of the year they wish to have their payment deferred. Dr. Hrabowski and Ms. Snowe elected to have their 2020 director fees deferred to 2021. Messrs. MacLellan, Stevens, Wilson and Ms. Wijnberg elected to have their 2020 director fees deferred into vested RSUs. Equity-Based Compensation in 2020 Pursuant to the 2017 Director Plan, each newly elected Board member is awarded an initial grant in the form, at their election, of restricted shares or RSUs having a value on the date of grant of $300,000 that vests one-year after the grant date. In each subsequent year, each non-employee director is awarded, at their election, restricted shares or RSUs having a value on the date of grant of $200,000 on the first business day after the Annual Meeting. Each of the award types vest upon the earliest of one year after the grant date, or the day before the annual meeting held in the calendar year after the year in which the grant is made, the non-employee director’s death or date on which the director becomes totally and permanently disabled, or the date on which a change in control occurs, provided the director continues to be a member of the Board on the applicable date. Restricted shares entitle the holder to the rights of a stockholder, including voting, dividend, and distribution rights, but are nontransferable until they vest. Vested stock units will be settled in shares of our common stock or cash, in the case of fractional shares, upon a non-employee director’s separation from service. Non-employee directors holding stock units are not entitled to voting, dividend, distribution, or other rights until the corresponding shares of our common stock are issued upon settlement; however, if and when we adopted with approval of stockholders certain amendmentspay a cash dividend to our chartercommon stockholders, we will issue dividend equivalents in the form of additional stock units. Under the 2017 Director Plan, dividends and dividend equivalents payable with respect to unvested restricted shares and unvested stock units will be subject to the same vesting and risks of forfeiture as the restricted shares and stock units to which they are attributable. The 2017 Director Plan includes a provision that eliminated voting limitations on stockholders holding 15%accelerates the vesting of all outstanding awards in connection with a change in control of Price Group. Upon a change in control, any outstanding stock units will be settled in cash or moreshares at the discretion of our outstanding common stock and removed a related super majority voting provision in our charter.the Board. Board Leadership

Chair of the Board of Directorsand Lead Independent Director In April 2017, Mr. Rogers assumed his role as the nonexecutive chair of the Board. Mr. Rogers has indicated he will retire from the Board effective as of the April 2019 Annual Meeting and, accordingly, will step down as our nonexecutive chair. The Board has announced that it will appoint Mr. Stromberg as the chair of the Board in addition to his current role as our president and CEO. By serving in both positions, Mr. Stromberg will be able to draw on his detailed knowledge of the Company to provide leadership to the Board in coordination with the lead independent director. The combined role of chair and CEO reflects our confidence in the leadership of Mr. Stromberg and also ensures that the Company presents its strategy to stockholders, employees and clients with a unified voice from the person most knowledgeable about and responsible for the implementation

| | |  | William J. Stromberg

Chair of the Board | | | Alan D. Wilson

Lead Independent Director | | | | | Mr. Stromberg was elected as the chair of the Board in addition to his role as our President and CEO at the April 2019 Board meeting. By serving in both positions, Mr. Stromberg has been able to draw on his detailed knowledge of the Company to provide leadership to the Board in coordination with the lead independent director. The combined role of chair and CEO reflects our confidence in the leadership of Mr. Stromberg and also ensures that the Company presents its strategy to clients, employees and stockholders with a unified voice from the person most knowledgeable about and responsible for the implementation of the Company’s strategy. | | | Mr. Wilson was elected by our independent directors as lead independent director after the 2018 Annual Meeting and is expected to be re-elected after the Annual Meeting. The lead independent director role was created in 2004 and has continually developed since that time. The lead independent director chairs Board meetings at which the chair is not present, approves Board agendas and meeting schedules, and oversees Board materials distributed in advance of Board meetings. The lead independent director also calls meetings of the independent directors, chairs all executive sessions of the independent directors, and acts as liaison between the independent directors and management. The lead independent director is available to the general counsel and corporate secretary to discuss and, as necessary, respond to stockholder communications to the Board. Mr. Wilson’s significant executive management experience, including having served as chair and chief executive officer of a publicly traded company, makes him especially qualified to serve as the lead independent director for the Board. |

PROXY STATEMENT 2019

17

Independent Leadership

TABLE OF CONTENTS

of the strategy. The Board has determined that the appointmentelection of ana lead independent lead director, together with a combined chair and CEO, serve the best interests of the Company and its stockholders at this time. The Board is confident that the duties and responsibilities allocated to its independent lead director, together with its other corporate governance practices and strong independent board, provides appropriate and effective independent oversight of management.

Lead Independent Director

The lead independent director role was created in 2004 and has continually developed since that time. The lead independent director chairs Board meetings at which the chair is not present, approves Board agendas and meeting schedules, and oversees Board materials distributed in advance of Board meetings. The lead independent director also calls meetings of the independent directors, chairs all executive sessions of the independent directors, and acts as liaison between the independent directors and management. The lead independent director is available to the chief legal counsel and corporate secretary to discuss and, as necessary, respond to stockholder communications to the Board.

Mr. Wilson was appointed by our independent directors as Lead Independent Director after the 2018 Annual Meeting and is expected to be reappointed after the Annual Meeting.

Independent Leadership

We believe that a well-empowered lead independent director provides independent leadership to our Board. The Company has a strong independent Board, and following the Annual Meeting, all of the members of the Board, other than Mr. Stromberg, will beare independent under the NASDAQ Global Select Market standards. In addition, thisthe Nominating and Corporate Governance Committee, the Audit Committee, and the Compensation Committee are all composed entirely of independent directors, and our chair and lead independent director, together with these Committees,committees, have significant and meaningful responsibilities designed to foster critical oversight and good governance practices. We believe that our structure is appropriate at this time and serves well the interests of the Company and its stockholders.

The Board is confident that the duties and responsibilities allocated to its lead independent director, together with its other corporate governance practices and strong independent board, provides appropriate and effective independent oversight of management. Committee Leadership and Rotation During

In 2015, Mr. Bartlett became the chair of the Audit Committee, Mr. MacLellan became the chair of the Executive Compensation Committee and Ms. Snowe became the chair of the Nominating and Corporate Governance Committee. Our Corporate Governance Guidelines provide that periodic rotation of committee membership and chairpersons is desirable,generally beneficial to the Company, and that chairpersons will generally be considered for change at least every five years. Thiscontributes to healthy and collaborative Board engagement. However, this rotation is not an absolute rule, however,mandatory, and in some circumstances continued service on a committee or as chair by persons with particular skills may be warranted. Director Qualifications and the Nominations Process

Director Replenishment and Tenure

Messrs. Rogers and Bernard are stepping down as members of our Board effective as of the 2019 Annual Meeting. They both have been longtime members of our Board and important contributors to the Company as senior executives holding a number of roles at the Company. H. Lawrence Culp, Jr. also resigned as a member of the Board in October 2018 in connection with his appointment as the chief executive officer of General Electric Company. Richard Verma was first elected to our Board at the 2018 Annual Meeting.

A number of our long-tenured directors retired over the last five years. After the 2019 Annual Meeting, the Board will have nine directors, eight of whom are independent. The tenure of our independent directors ranges from one to nine At least every 5 years, with an average tenure of approximately five years. Only three of our directors have a tenure of greater than five years. Given the foregoing, and in light of trends with other boards of directors, during 2018 we increased our mandatory retirement age for directors from 72 years of age to 75 years of age.